Boeing, commonly traded under the ticker symbol BA stock, is one of the most prominent companies in the aerospace and defense industry. With a legacy spanning over a century, Boeing has positioned itself as a leader in manufacturing commercial airplanes, military aircraft, and space systems. For investors, BA stock represents an opportunity to own a stake in a company that plays a crucial role in both the global economy and the defense sector.

This article provides an in-depth look at BA stock, its performance, market trends, and the factors investors should consider before adding it to their portfolios. From the company’s financial performance to its long-term growth prospects, we’ll cover all the essential elements investors need to make informed decisions about Boeing stock.

Overview of Boeing (BA) and Its Market Position

History and Background of Boeing

Founded in 1916 by William Boeing, the Boeing Company has become one of the world’s largest aerospace manufacturers. Initially focused on building airplanes, Boeing expanded its operations to include military aircraft, satellites, and commercial space ventures.

Boeing’s commercial airline segment, responsible for producing popular models like the 737, 747, and 787 Dreamliner, represents a significant portion of its revenue. Meanwhile, its defense, space, and security divisions have solidified its place in the global defense industry, offering products and services to various government agencies and military forces worldwide.

Boeing’s Global Impact and Reputation

Boeing is a key player in the global aviation market, often competing with its European counterpart Airbus. Its innovations in aerospace technology have reshaped global travel, while its defense contracts have supported military operations worldwide. The company’s ability to maintain a strong foothold in both commercial and defense sectors makes BA stock attractive to a broad spectrum of investors.

However, like any major corporation, Boeing has faced its share of challenges, including production delays, safety concerns, and global crises that affect air travel. These factors contribute to the volatility seen in BA stock, making it essential for investors to stay informed.

BA Stock Performance: A Historical Perspective

BA Stock’s Performance Over the Years

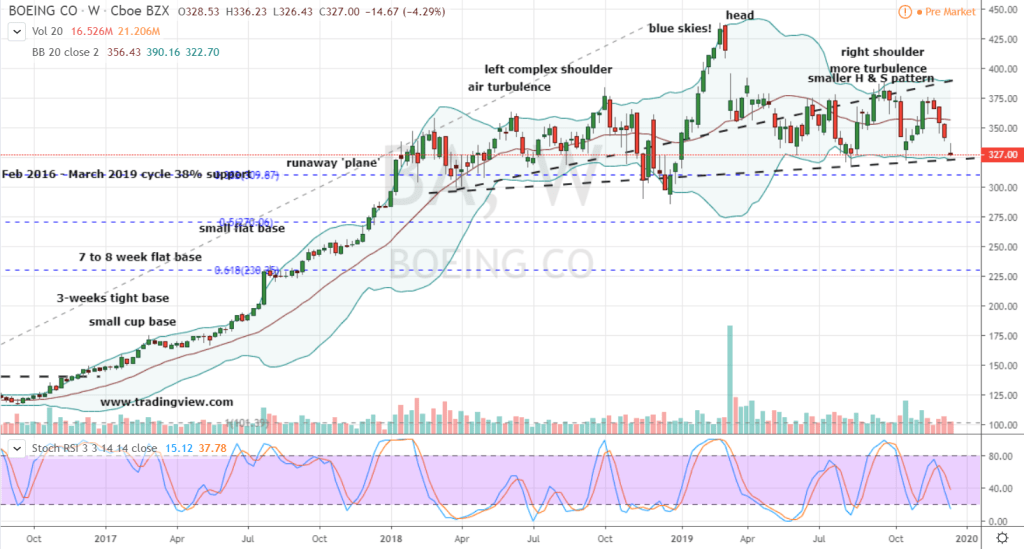

BA stock has experienced significant highs and lows over the past few decades. In the 1990s and early 2000s, Boeing’s stock was seen as a stable investment, as the company consistently secured defense contracts and increased its market share in the commercial airline industry. The rapid growth of global air travel in the 21st century further boosted BA stock, making it a favorite among long-term investors.

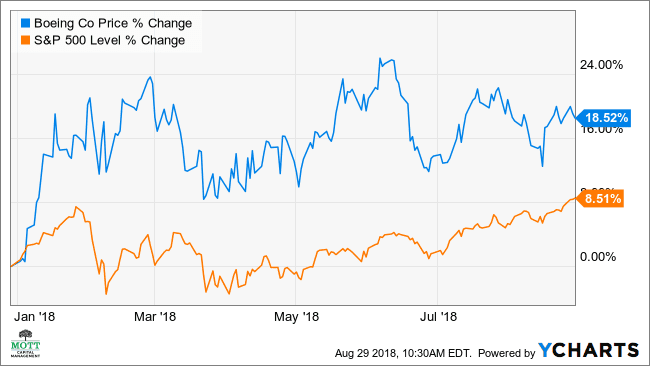

In 2018, BA stock reached an all-time high, driven by strong demand for Boeing’s 737 MAX jets and the company’s aggressive expansion plans. However, the stock experienced a sharp decline in 2019 after the grounding of the 737 MAX fleet following two fatal crashes. This crisis severely impacted Boeing’s reputation and financial standing, leading to a prolonged downturn in its stock price.

Impact of COVID-19 on BA Stock

The COVID-19 pandemic dealt another blow to BA stock as global air travel came to a near standstill. With airlines canceling orders and delaying deliveries, Boeing faced unprecedented challenges. The stock saw a significant decline in 2020 as the company struggled to cope with the dual pressures of the 737 MAX crisis and the global pandemic.

However, Boeing began to recover in 2021 as air travel slowly resumed, and the 737 MAX was recertified for flight. Investors who were able to hold on during the tough times saw a gradual improvement in BA stock’s value, but it remains below its pre-crisis highs.

Key Factors Influencing BA Stock

Commercial Aviation Recovery

One of the primary factors affecting BA stock is the recovery of the global commercial aviation industry. As air travel demand increases post-pandemic, airlines are once again placing orders for new aircraft. Boeing’s success in ramping up production and meeting this demand will be critical for BA stock’s performance moving forward.

The reintroduction of the 737 MAX and the ongoing development of new aircraft models like the 777X are expected to play a significant role in Boeing’s future profitability. Investors will need to keep an eye on production schedules and order backlogs to gauge Boeing’s ability to capitalize on the recovery in air travel.

Defense Contracts and Government Spending

Boeing’s defense division provides a more stable revenue stream compared to its commercial airline business. Government contracts for military aircraft, drones, and space systems provide Boeing with steady cash flow, even during downturns in the aviation industry. Defense spending, particularly from the U.S. government, will continue to be a key factor supporting BA stock in the years ahead.

For investors, understanding the scope and duration of Boeing’s defense contracts can offer insight into the company’s long-term financial health. Any changes in government spending or geopolitical tensions could also impact BA stock’s performance.

Supply Chain Challenges

Like many manufacturers, Boeing is heavily reliant on a complex global supply chain to produce its aircraft and defense products. Disruptions in the supply chain, whether due to geopolitical issues, material shortages, or labor strikes, can have a significant impact on Boeing’s ability to meet production targets.

The COVID-19 pandemic exposed many vulnerabilities in Boeing’s supply chain, and the company has since worked to address these issues. However, supply chain challenges remain a potential risk factor for BA stock, and investors should monitor these developments closely.

BA Stock: Financials and Valuation

Revenue and Earnings Growth

Boeing’s revenue has fluctuated in recent years due to the 737 MAX crisis and the impact of COVID-19 on the aviation industry. Prior to these challenges, Boeing generated steady revenue growth from both its commercial and defense divisions. As the aviation industry recovers and Boeing resumes full production, analysts expect to see a gradual improvement in the company’s earnings.

Investors should also note that Boeing has faced significant costs related to the 737 MAX grounding, including compensation to airlines and increased regulatory scrutiny. These factors have weighed on Boeing’s profitability, but with the resumption of deliveries, there is potential for revenue growth in the coming years.

Dividend History and Payouts

Boeing has historically been a dividend-paying stock, attracting income-seeking investors. However, the company suspended its dividend payments in 2020 as it sought to preserve cash during the pandemic. While some investors view this as a setback, it was a necessary step to stabilize the company’s finances.

There is speculation that Boeing could resume dividend payments in the future, once its cash flow improves. For long-term investors, the potential for dividend reinstatement could be an attractive feature of BA stock.

Valuation Metrics

Boeing’s current price-to-earnings (P/E) ratio, price-to-sales (P/S) ratio, and other valuation metrics indicate that the stock may still be trading at a discount compared to its historical levels. This presents an opportunity for value investors who believe in Boeing’s ability to rebound as global air travel picks up and defense spending remains strong.

You may also like to read: Powering Homes and Businesses Safely and Responsibly

However, given the challenges Boeing has faced in recent years, it is essential to balance optimism with caution. Investors should conduct thorough research and consider the risks associated with BA stock before making any investment decisions.

Is BA Stock a Good Buy? Pros and Cons

Pros of Investing in BA Stock

- Global Market Leader: Boeing is one of the largest and most influential companies in the aerospace and defense industry. Its market position ensures long-term relevance.

- Recovery Potential: With the 737 MAX reentering service and air travel recovering, there is significant growth potential for Boeing’s commercial division.

- Diversified Business Model: Boeing’s defense and space sectors provide a steady revenue stream, helping to balance the volatility in its commercial airline division.

- Long-Term Growth Prospects: As new technologies emerge in aviation, space exploration, and defense, Boeing is well-positioned to benefit from innovation and increased demand for its products.

Cons of Investing in BA Stock

- Volatility: BA stock has experienced extreme volatility due to crises such as the 737 MAX grounding and the pandemic. Future volatility remains a risk for investors.

- Supply Chain Risks: Disruptions in the supply chain could impact Boeing’s ability to meet production goals and maintain profitability.

- Debt Load: Boeing has taken on significant debt in recent years to weather the challenges it faced. Managing this debt will be crucial to the company’s future financial health.

- Regulatory and Legal Challenges: Boeing continues to face regulatory scrutiny following the 737 MAX incidents. Ongoing legal issues could impact the company’s finances.

Frequently Asked Questions (FAQs)

1. Is BA stock a good long-term investment?

BA stock has strong long-term potential, especially as the aviation industry recovers and Boeing’s defense contracts provide stability. However, investors should be mindful of the risks associated with the stock’s volatility.

2. Does Boeing pay dividends?

Boeing suspended its dividend payments in 2020 to preserve cash during the pandemic. There is potential for the dividend to be reinstated once the company’s financial position improves.

3. What are the main risks associated with BA stock?

The main risks include supply chain disruptions, legal challenges from the 737 MAX crisis, and volatility due to external factors such as pandemics or economic downturns.

4. How does Boeing compare to Airbus?

Boeing and Airbus are the two largest manufacturers of commercial airplanes. Both companies have their strengths, but Boeing has faced more challenges in recent years due to the 737 MAX crisis.

5. What sectors does Boeing operate in?

Boeing operates in commercial aviation, defense, and space exploration, making it a diversified company within the aerospace industry.

6. What should investors watch for in BA stock?

Investors should monitor Boeing’s production timelines, order backlogs, and financial recovery post-pandemic. Additionally, any news related to the defense sector and global air travel demand will impact BA stock.

Conclusion: The Future of BA Stock

BA stock represents an intriguing opportunity for investors looking to gain exposure to the aerospace and defense sectors. With Boeing’s global influence, the recovery of the aviation industry, and its solid defense business, the company is poised for growth in the coming years. However, challenges remain, and potential investors must weigh the risks of volatility and external market factors.

For those with a long-term investment horizon, BA stock offers the potential for solid returns as the company works to overcome its recent struggles and capitalize on its role as a leader in both commercial and defense sectors.