In today’s fast-paced business world, having access to adequate financial resources is essential for growth and sustainability. This is where Capital Injection Monievest comes into play. capital injection monievest can be a game-changer whether you are a startup or an established company looking to expand. In this article, we will delve into the concept of capital injection, explore how Monievest can help, and provide valuable insights on maximizing this financial strategy for your business.

Understanding Capital Injection

Capital injection refers to the infusion of funds into a business to support various activities such as expansion, research and development, debt reduction, or operational needs. These funds can come from various sources, including investors, venture capitalists, or financial institutions. The primary goal of capital injection monievest is to provide the necessary liquidity to help businesses achieve their objectives.

What is Monievest?

Monievest is a financial service provider specializing in capital injection money solutions for businesses of all sizes. With a reputation for reliability and tailored financial products, Monievest stands out as a trusted partner for companies seeking to boost their financial health and drive growth.

The Importance of Capital Injection for Business Growth

Capital injection monies play a crucial role in business growth for several reasons:

- Facilitates Expansion: With adequate funding, businesses can explore new markets, increase production capacity, and invest in infrastructure.

- Enhances Innovation: Capital allows companies to invest in research and development, leading to innovative products and services.

- Strengthens Financial Stability: Businesses can achieve excellent financial stability and resilience by reducing debt or improving cash flow.

- Attracts Talent: Financial resources enable businesses to attract and retain top talent by offering competitive salaries and benefits.

How Capital Injection Monievest Can Help Your Business

Monievest provides a range of capital injection money services designed to meet the unique needs of each business. Here are some ways Monievest can help:

- Tailored Financial Solutions: Monievest understands that every business is unique. They offer customized capital injection plans aligning with your goals and requirements.

- Flexible Funding Options: Monievest provides flexible funding options to suit your needs, whether you need a short-term loan or long-term investment.

- Expert Financial Advice: With a team of financial experts, Monievest offers valuable advice and support to help you make informed decisions about your capital injection money strategy.

- Quick and Easy Process: Monievest’s streamlined application process ensures you get the necessary funds without unnecessary delays.

Steps to Secure Capital Injection from Monievest

Securing capital injection from Monievest involves a straightforward process:

- Assessment: Begin with thoroughly assessing your business needs and financial situation.

- Application: Submit your application, including detailed business plans and financial projections.

- Evaluation: Monievest evaluates your application and proposes a tailored funding solution.

- Approval and Disbursement: Upon approval, the funds are disbursed quickly to support your business objectives.

Maximizing the Benefits of Capital Injection

To fully leverage the benefits of capital injection, consider the following strategies:

- Clear Objectives: Define clear, achievable objectives for how you will use the injected capital.

- Effective Budgeting: Create a detailed budget to ensure the funds are allocated efficiently.

- Regular Monitoring: Continuously monitor the impact of the capital injection on your business performance.

- Strategic Investment: Invest in areas that promise the highest return on investment, such as technology, marketing, or talent acquisition.

- Found this article valuable? Our blog has plenty more to offer.

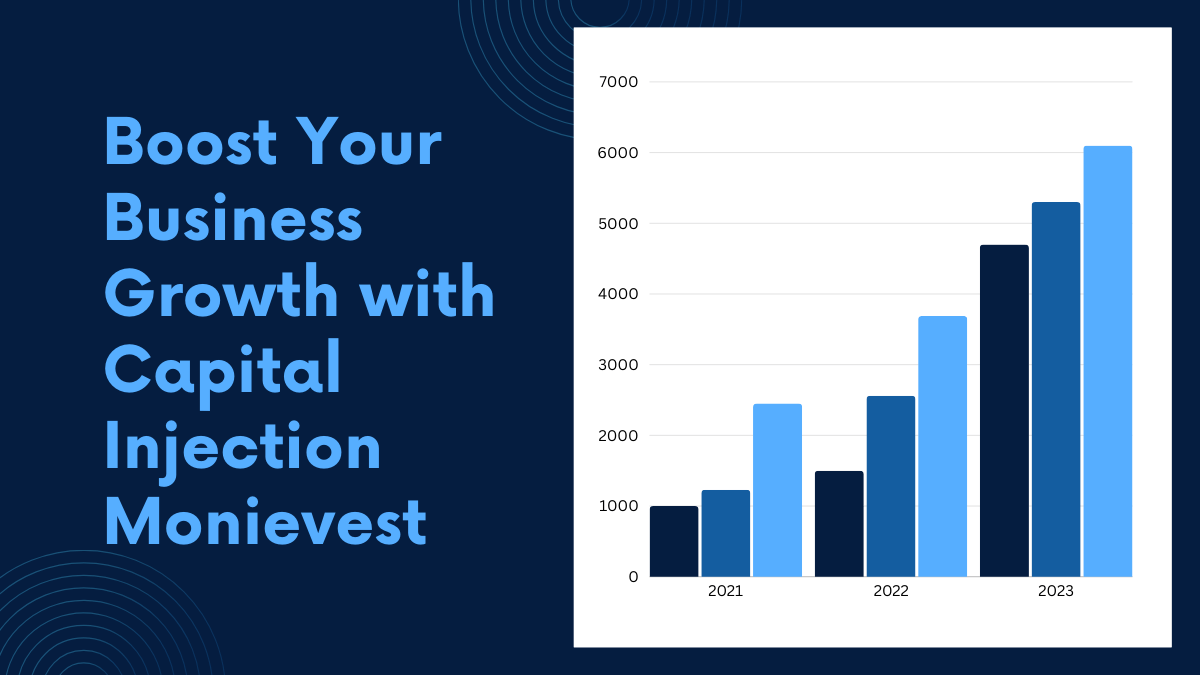

Case Study: Success with Capital Injection Monievest

Consider the case of TechInnovate, a startup specializing in AI-driven solutions. Facing cash flow challenges, TechInnovate approached Monievest for capital injection. With a tailored funding plan and strategic advice from Monievest, TechInnovate was able to:

- Expand Operations: Open new offices in key markets.

- Invest in R&D: Develop innovative products that set them apart from competitors.

- Hire Top Talent: Attract skilled professionals to drive growth.

Within a year, TechInnovate saw a significant increase in revenue and market share, highlighting the transformative power of capital injection from Monievest.

Common Challenges and How Monievest Overcomes Them

While capital injection offers numerous benefits, businesses may face challenges such as:

- High-Interest Rates: Some funding options come with high interest rates that can strain finances. Monievest provides competitive rates to ensure affordability.

- Complex Application Processes: Lengthy and complicated applications can delay funding. Monievest’s streamlined process ensures quick access to funds.

- Risk of Overleveraging: Excessive borrowing can lead to financial instability. Monievest offers expert advice to maintain a healthy balance.

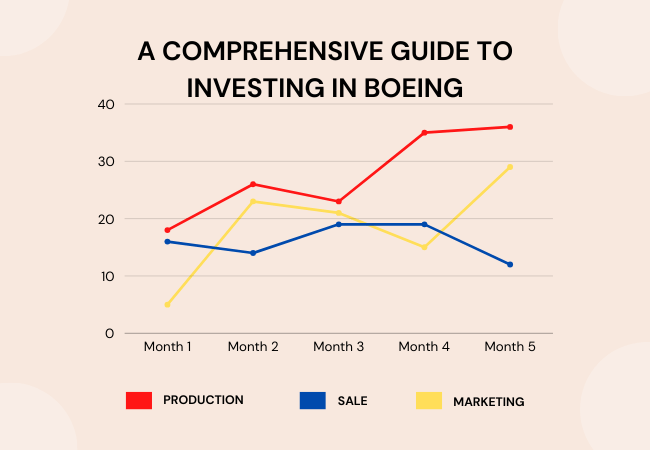

Future Trends in Capital Injection

As the business landscape evolves, several trends are shaping the future of capital injection:

- Digital Transformation: Increasing use of digital platforms for quicker and more efficient funding processes.

- Sustainability Focus: Growing emphasis on funding environmentally sustainable and socially responsible businesses.

- AI and Data Analytics: Leveraging AI and data analytics to assess risk and optimize funding decisions.

FAQs

What is capital injection?

Capital injection is the infusion of funds into a business to support activities such as expansion, debt reduction, or operational needs.

How does Monievest assist with capital injection?

Monievest provides tailored financial solutions, flexible funding options, expert advice, and a streamlined application process to help businesses secure the necessary funds.

What types of businesses can benefit from capital injection Monievest?

Businesses of all sizes and industries can benefit, including startups, growing companies, and established enterprises seeking expansion or stability.

What are the key benefits of capital injection?

Capital injection facilitates expansion, enhances innovation, strengthens financial stability, and attracts top talent.

How can businesses maximize the benefits of capital injection?

By setting clear objectives, effective budgeting, regular monitoring, and strategic investment, businesses can fully leverage the benefits of capital injection.

What are the common challenges in securing capital injection?

Challenges include high interest rates, complex application processes, and the risk of overleveraging, which Monievest addresses with competitive rates, a streamlined process, and expert advice.

Conclusion

In the dynamic world of business, having access to adequate capital is crucial for growth and sustainability. Capital Injection Monievest offers a reliable and efficient way to secure the funds your business needs to thrive. By understanding the importance of capital injection, leveraging the expertise and tailored solutions provided by Monievest, and implementing effective strategies, you can drive your business toward a prosperous future. Embrace the power of capital injection today and unlock new opportunities for success with Monievest.Did you like this article? Uncover more insights on our blog.